Transferring money between different banking platforms has become increasingly convenient with the advent of digital payment systems. One common pairing is Zelle and Chime, two popular services offering hassle-free transactions. In this guide, we’ll delve into the process of transferring funds from Zelle to Chime seamlessly.

Understanding Zelle and Chime:

Before diving into the transfer process, it’s essential to understand the basics of both Zelle and Chime. Zelle is a digital payment network that enables users to send and receive money quickly and securely using only an email address or phone number.

On the other hand, Chime is a mobile banking platform known for its user-friendly interface and fee-free services, making it a popular choice among consumers.

Compatibility Between Zelle and Chime:

One crucial aspect to consider before initiating a transfer is the compatibility between Zelle and Chime. As of now, Chime does not directly support Zelle transfers. However, there are alternative methods to move funds from your Zelle account to your Chime account seamlessly.

Read Exploring the Beauty of black belgian malinois

Using a Linked External Bank Account:

The most straightforward method to transfer funds from Zelle to Chime is by utilizing a linked external bank account. First, ensure that your Chime account is linked to an external bank account that supports Zelle transfers.

Then, initiate a transfer from your Zelle account to the linked external bank account. Once the funds are available in the external account, you can transfer them to your Chime account instantly using Chime’s “Move Money” feature.

Transferring Funds via ACH Transfer:

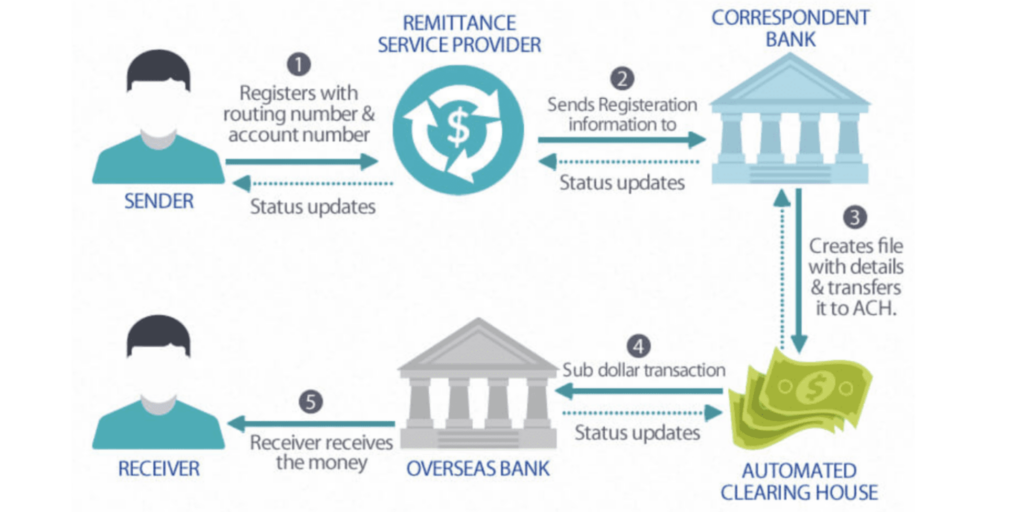

Another option to transfer money from Zelle to Chime is through an ACH (Automated Clearing House) transfer. This method involves withdrawing funds from your Zelle account and depositing them into your Chime account using the ACH network.

While ACH transfers may take a few business days to complete, they offer a reliable way to move funds between different banking platforms.

Considerations and Fees:

When transferring funds between Zelle and Chime through an external bank account or ACH transfer, it’s essential to be mindful of any associated fees or processing times.

While Chime typically does not charge fees for incoming transfers, your external bank may impose charges for outbound transfers or ACH transactions. Additionally, factor in the processing times for both Zelle and Chime transfers to ensure timely delivery of funds.

Leveraging Third-Party Payment Apps:

Some third-party payment apps serve as intermediaries between Zelle and Chime, facilitating transfers between the two platforms. Apps like PayPal or Venmo allow users to send money to their accounts and then transfer it to their Chime account.

To utilize this method, link your Zelle account to the third-party app, transfer the funds, and then withdraw them to your Chime account. However, be aware of any associated fees or processing times with these intermediary services.

Utilizing Peer-to-Peer Transfer Services:

Peer-to-peer (P2P) transfer services, such as Cash App or Square Cash, offer another avenue for transferring funds from Zelle to Chime. Similar to third-party payment apps, users can link their Zelle account to the P2P service, transfer the funds, and subsequently transfer them to their Chime account. Keep in mind any fees or transaction limits imposed by the P2P service when utilizing this method.

Exploring Alternative Transfer Options:

Beyond traditional methods, exploring alternative transfer options can provide additional avenues for moving funds between Zelle and Chime. For example, consider using prepaid debit cards that are compatible with both platforms to facilitate transfers.

Alternatively, explore peer-to-peer cryptocurrency exchanges that allow users to convert Zelle funds into digital currencies, which can then be transferred to a Chime account.

Understanding Zelle and Chime Policies:

Before initiating any transfer, it’s crucial to familiarize yourself with the policies and terms of service of both Zelle and Chime. Pay attention to any restrictions, limitations, or fees associated with transferring funds between the two platforms. Understanding these policies can help avoid any unexpected hurdles or complications during the transfer process.

Seeking Customer Support Assistance:

If you encounter difficulties or have questions regarding transferring funds from Zelle to Chime, don’t hesitate to reach out to customer support for assistance.

Both Zelle and Chime offer customer support channels, including online chat, email, and phone support, where you can seek guidance or clarification on the transfer process.

Customer support representatives can provide personalized assistance and help troubleshoot any issues you may encounter during the transfer process.

Read weasel zippers | Unraveling the Stories Behind the Headlines

Exploring Interbank Transfer Options:

Investigate whether your Zelle-linked bank offers interbank transfer services that facilitate transfers to external accounts, including Chime. Some banks offer transfer options that allow you to send funds directly from your Zelle-linked account to your Chime account, bypassing the need for intermediary steps. Check with your bank to see if this option is available and if any fees or limitations apply.

Leveraging Chime’s Pay Friends Feature:

Chime offers a feature called “Pay Friends,” which enables users to send money to friends or contacts who also have Chime accounts. While this feature primarily focuses on internal transfers between Chime users, you can leverage it creatively to transfer funds from your Zelle account to your Chime account.

Add your Zelle account as a contact within Chime’s Pay Friends feature, send the funds from Zelle to your Chime contact, and then transfer them to your Chime account. Be mindful of any transaction limits or fees associated with Chime’s Pay Friends feature.

Exploring Alternative Payment Platforms:

Consider exploring alternative payment platforms beyond Zelle and Chime that may offer more seamless integration or transfer options. Services like Google Pay or Apple Pay allow users to link multiple bank accounts and facilitate transfers between them.

Investigate whether these platforms support both Zelle and Chime accounts and explore the transfer options available. Be sure to review any fees, security features, and transfer limits associated with these alternative payment platforms before initiating transfers.

Conclusion:

While direct transfers from Zelle to Chime are not currently supported, users can still move funds between these platforms using alternative methods. By leveraging a linked external bank account or initiating an ACH transfer, individuals can seamlessly transfer money from their Zelle account to their Chime account. Understanding the compatibility and procedures involved in these transfers is essential for a smooth and hassle-free experience.

Read Also: